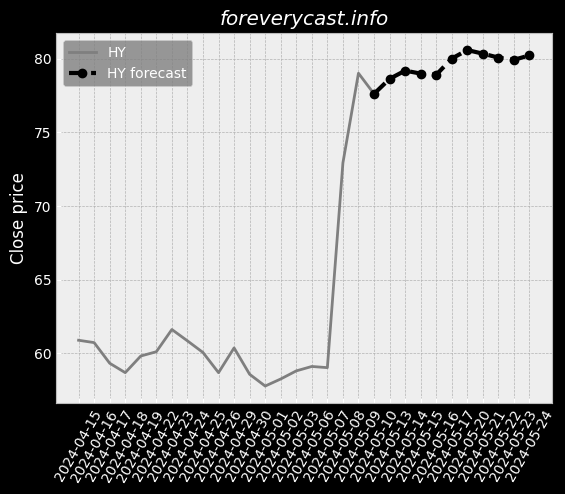

TEREX CORP stock forecast: down to 59.42 USD TEX stock price prognosis

STOCK

Forecast for Wed 03 Jul 2024 price 57.23

TEREX CORP stock price forecast for further price development down to -4.04% (time horizon: 1 day) and price target of 59.42 USD. Short-term (time horizon: 2 weeks) TEREX CORP share price prediction for 2024-07-03 with daily closed price projections

Key Facts

Symbol TEX

ISIN US8807791038

CUSIP 880779103

Currency USD

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 3,107,000,000.0

Earnings per share 0.77

Dividends 0.12