RCI HOSPITALITY HOLDINGS INC stock forecast: down to 54.18 USD RICK stock price prognosis

STOCK

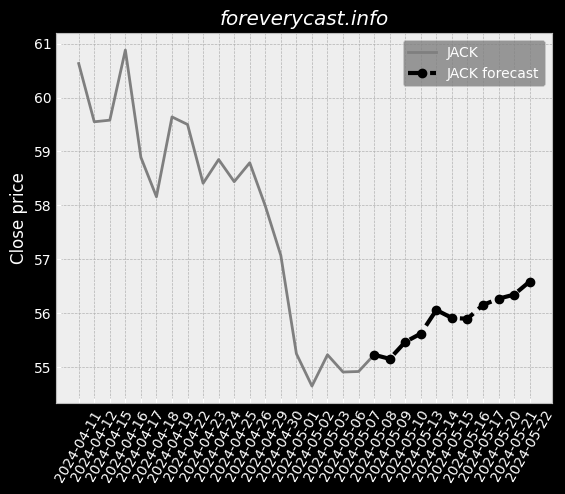

Forecast for Fri 21 Jun 2024 price 56.98

RCI HOSPITALITY HOLDINGS INC stock price forecast for further price development down to -2.21% (time horizon: 1 day) and price target of 54.18 USD. Short-term (time horizon: 2 weeks) RCI HOSPITALITY HOLDINGS INC share price prediction for 2024-06-21 with daily closed price projections

Key Facts

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 125,964,000.0

Earnings per share 0.85

Dividends 0.15