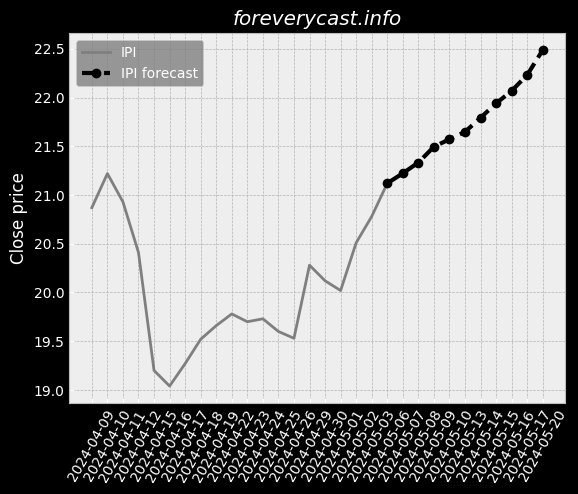

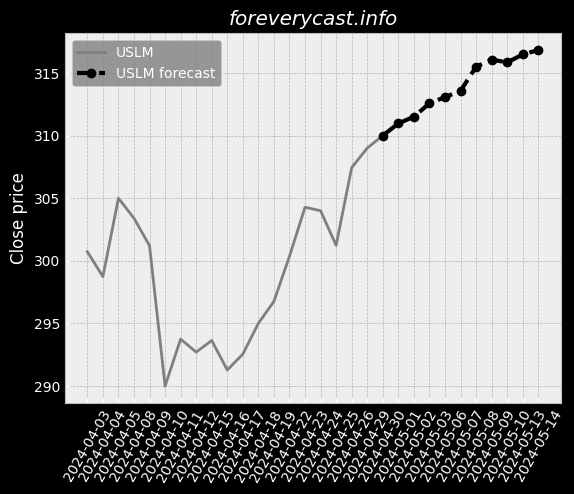

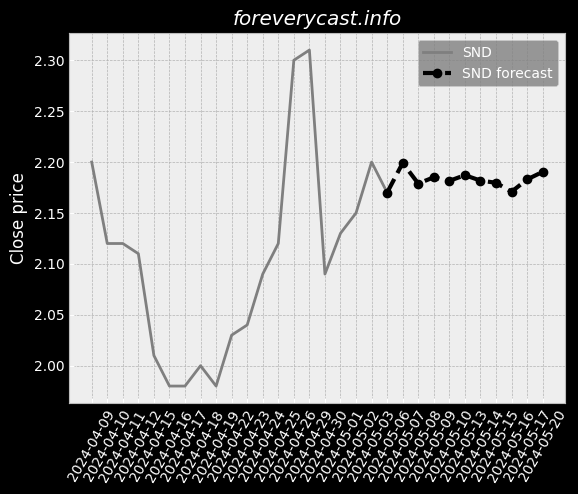

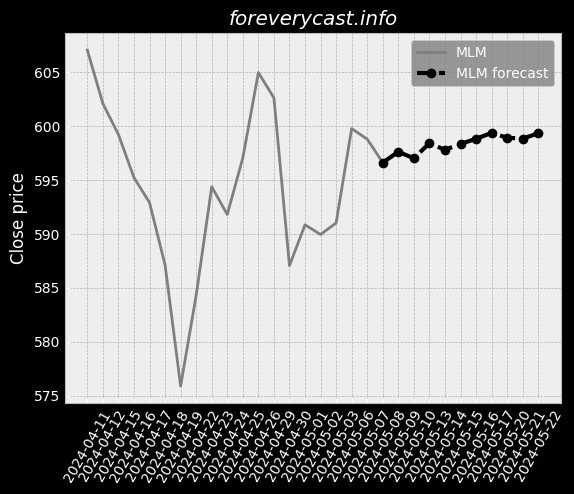

MDU RESOURCES GROUP INC stock forecast: up to 25.04 USD MDU stock price prognosis

STOCK

Forecast for Fri 21 Jun 2024 price 25.32

MDU RESOURCES GROUP INC stock price forecast for further price development up to 7.83% (time horizon: 1 day) and price target of 25.04 USD. Short-term (time horizon: 2 weeks) MDU RESOURCES GROUP INC share price prediction for 2024-06-21 with daily closed price projections

Key Facts

Symbol MDU

ISIN US5526901096

CUSIP 552690109

Currency USD

Category Mining, Quarrying Of Nonmetallic Minerals (No Fuels)

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 5,561,000,000.0

Earnings per share 2.08

Dividends 0.84