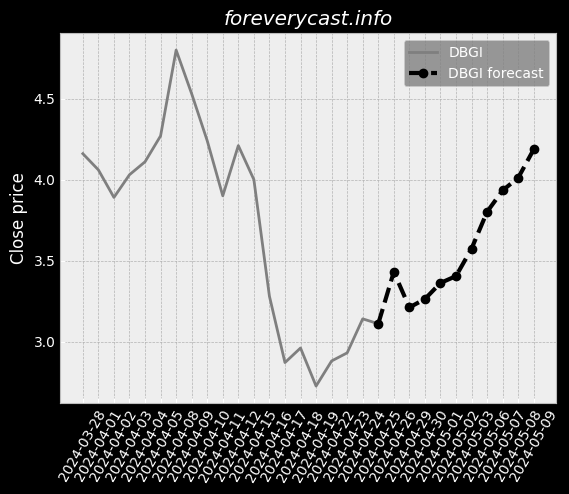

Hanesbrands Inc stock forecast: down to 4.39 USD HBI stock price prognosis

STOCK

Forecast for Fri 21 Jun 2024 price 4.24

Hanesbrands Inc stock price forecast for further price development down to -18.11% (time horizon: 1 day) and price target of 4.39 USD. Short-term (time horizon: 2 weeks) Hanesbrands Inc share price prediction for 2024-06-21 with daily closed price projections

Key Facts

Symbol HBI

ISIN US4103451021

CUSIP 410345102

Currency USD

Category Retail-Apparel & Accessory Stores

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 6,968,000,000.0

Earnings per share -0.94

Dividends 0.60