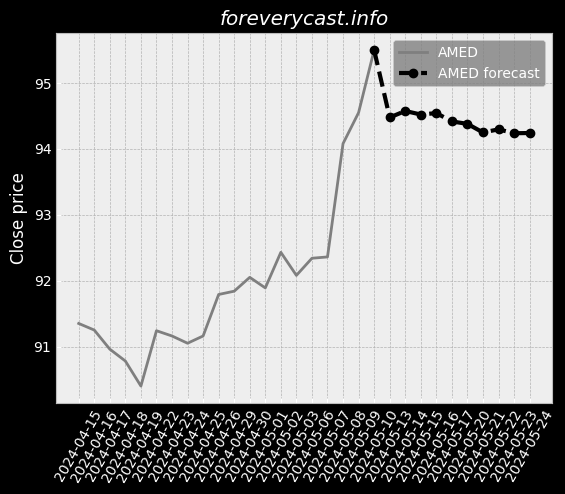

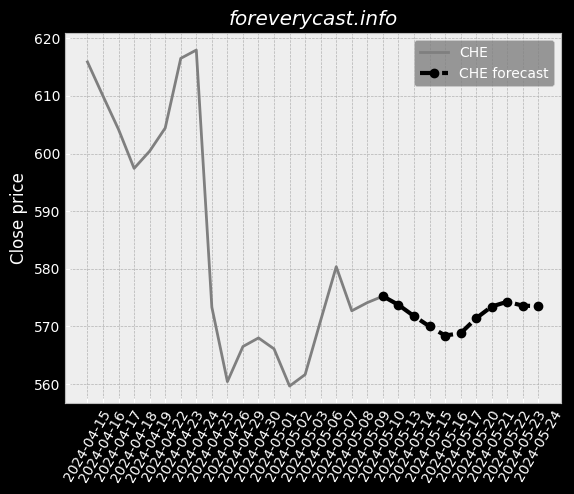

ADDUS HOMECARE CORP stock forecast: down to 93.58 USD ADUS stock price prognosis

STOCK

Forecast for Fri 21 Jun 2024 price 93.56

ADDUS HOMECARE CORP stock price forecast for further price development down to -8.75% (time horizon: 1 day) and price target of 93.58 USD. Short-term (time horizon: 2 weeks) ADDUS HOMECARE CORP share price prediction for 2024-06-21 with daily closed price projections

Key Facts

Symbol ADUS

ISIN US0067391062

CUSIP 006739106

Currency USD

Category Services-Home Health Care Services

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 779,861,000.0

Earnings per share 2.09