FIRST FINANCIAL CORPORATION INDIAN stock forecast: up to 37.82 USD THFF stock price prognosis

STOCK

Forecast for Tue 18 Jun 2024 price 38.39

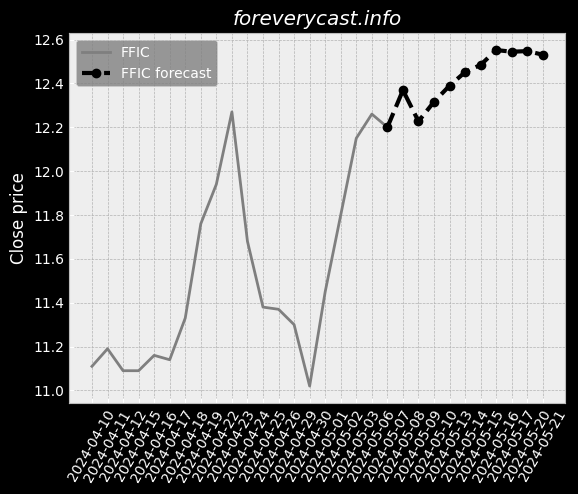

FIRST FINANCIAL CORPORATION INDIAN stock price forecast for further price development up to 2.11% (time horizon: 1 day) and price target of 37.82 USD. Negative news sentiment. Short-term (time horizon: 2 weeks) FIRST FINANCIAL CORPORATION INDIAN share price prediction for 2024-06-18 with daily closed price projections

Key Facts

Forecast price change %

News sentiment (-0.01)

News <--> Close correlation for next day influence ()

Relative Strength Index (RSI)

Finance numbers

Revenue 199,113,000.0

Earnings per share 3.99

Dividends 1.05