VALMONT INDS INC stock forecast: up to 220.18 USD VMI stock price prognosis

STOCK

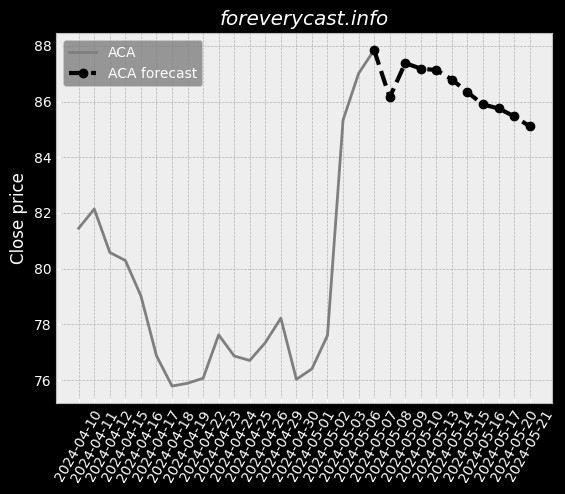

Forecast for Tue 18 Jun 2024 price 225.79

VALMONT INDS INC stock price forecast for further price development up to 0.19% (time horizon: 1 day) and price target of 220.18 USD. Short-term (time horizon: 2 weeks) VALMONT INDS INC share price prediction for 2024-06-18 with daily closed price projections

Key Facts

Symbol VMI

ISIN US9202531011

CUSIP 920253101

Currency USD

Category Fabricated Structural Metal Products

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 2,996,041,000.0

Earnings per share 7.15

Dividends 1.85