USD/VEF Prognosis: down to 0.00 US-Dollar to Venezuelan Bolívar Fuerte Converter, Analysis, Prediction Forex Forecast

CURRENCY

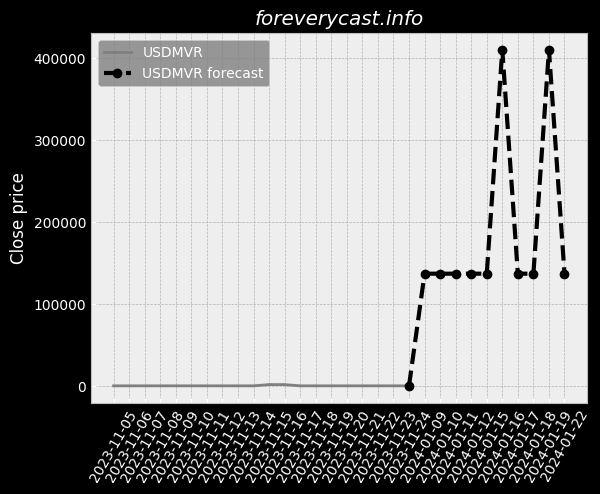

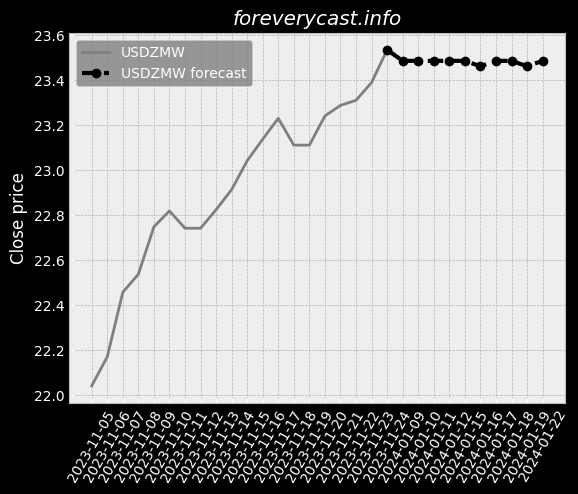

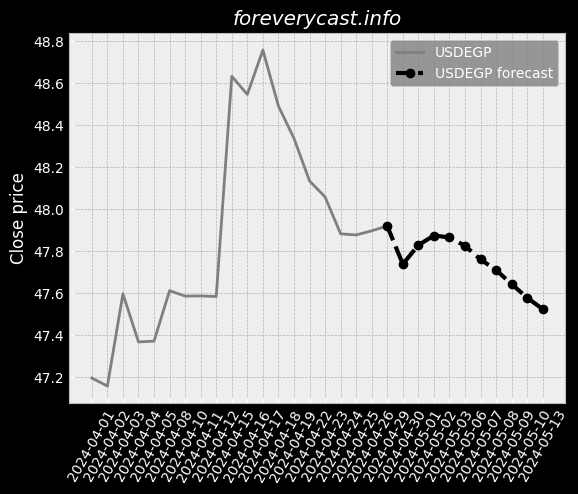

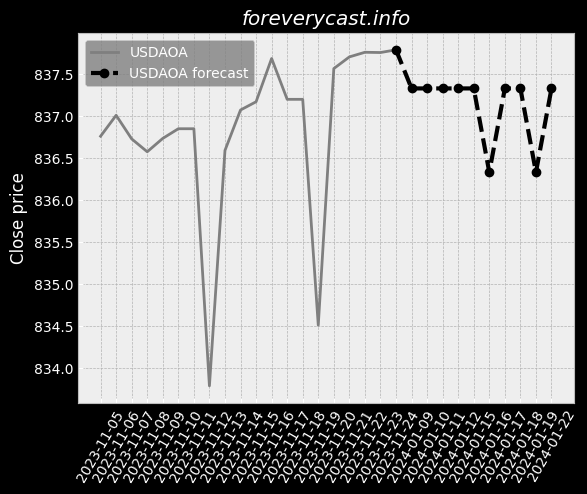

Exchange rate (USD - VEF) forecast for Fri 27 Dec 2024 rate 3353867.50 VEF

USD/VEF Forecast, US-Dollar to Venezuelan Bolívar Fuerte foreign exchange rate prediction. Short-term (time horizon: 1 day) USD to VEF Forex (FX) prognosis for 2024-12-27 with daily FX rate projections. Custom value / amount input USD <-> VEF to simplify statistical analysis

Key Facts

Symbol USDVEF

Exchange rate USD - Venezuelan Bolívar Fuerte

Forecast price change %

Relative Strength Index (RSI)

Exchange amount

Calculate custom amount exchange