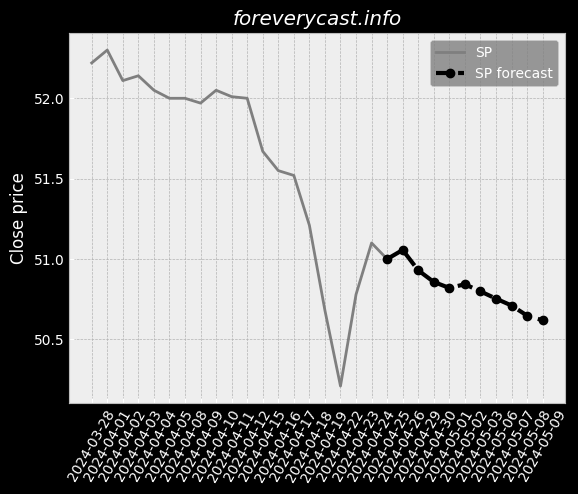

RYDER SYSTEM INC stock forecast: down to 109.09 USD R stock price prognosis

STOCK

Forecast for Tue 18 Jun 2024 price 107.92

RYDER SYSTEM INC stock price forecast for further price development down to -6.42% (time horizon: 1 day) and price target of 109.09 USD. Short-term (time horizon: 2 weeks) RYDER SYSTEM INC share price prediction for 2024-06-18 with daily closed price projections

Key Facts

Symbol R

ISIN US7835491082

CUSIP 783549108

Currency USD

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 8,478,000,000.0

Earnings per share 0.71

Dividends 2.24