Nucor Corp. stock forecast: down to 169.87 USD NUE stock price prognosis

STOCK

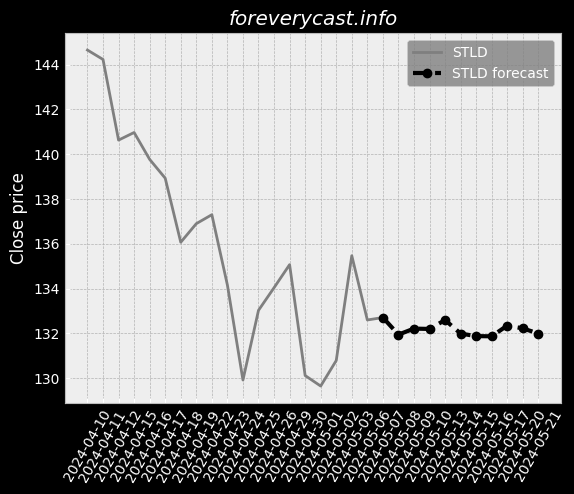

Forecast for Thu 20 Jun 2024 price 168.09

Nucor Corp. stock price forecast for further price development down to -13.10% (time horizon: 1 day) and price target of 169.87 USD. Short-term (time horizon: 2 weeks) Nucor Corp. share price prediction for 2024-06-20 with daily closed price projections

Key Facts

Symbol NUE

ISIN US6703461052

CUSIP 670346105

Currency USD

Category Steel Works, Blast Furnaces Rolling Mills (Coke Ovens)

Forecast price change %

Relative Strength Index (RSI)

Finance numbers

Revenue 21,531,000,000.0

Earnings per share 5.39

Dividends 1.62